tax per mile reddit

This is assuming you have say 10 Pre-Tax 90 Roth in your 401k and you are trying to avoid high-income tax brackets during retirement. Another way of deducting auto expenses is by keeping track of actual itemized expenses such as gas insurance and car payments and deducting the pro rata share used for business at the end of the year.

Uber Vs Lyft Infographic Uber Vs Lyft Lyft Uber

So you are correct in your assumption that you will be taxed on the additional 5p per mile.

. The Indianapolis 500 consists of 200 25 mile laps. Indiana has a flat statewide income tax. The bill would leave VinFast reservation holders without the 7500 federal tax credit but the Vietnamese company is prepared to go the extra mile to ensure its customers get the deal they were.

Make quarterly payments of. A well run hotshot trucker in a reasonable location for regular loads can bring in from 60000 to 120000 gross income per year possibly more. He also owned a house prior to this house and she paid towards that mortgage for 6 years.

If you give an inch they take a mile. Doordash taxes reddit 2021 home artista doordash taxes reddit 2021. Most hotshots expensesfuel maintenance insurance licenses and fees tolls etcare approximately half of gross incomeTime and fiscal management are critically important to succeed as a hotshot9.

My plan was to spend 10k on. Getty As he walked away the woman hurled the normal insults his way Mom-to-Be Wonders AITA After Storming Out of Her Surprise Baby Shower Because Her Family Wasnt Invited February 17 2020 February 14 2020 Parenting Pregnancy By Sara Vallone When a soon-to-be mom and her husband were getting ready to. The standard mileage deduction is the simplest way to deduct business-related travel expenses with a rate of 56 cents per mile for 2021.

An apparel company can post weekly or monthly style predictions and outfit tips per season. Option 2 is called the standard mileage deduction and it usually saves drivers more money at tax time than itemizing all car expenses. As it turns out the standard mileage rate is pretty generous unless you drive a gas guzzler.

However the tax-free amount is 45p per mile. The Seven Mile Bridge connects Knights Key part of the city of Marathon Florida in the Middle Keys to Little Duck Key in the Lower KeysAmong the longest bridges in existence when it was built it. You could be required to take out more income.

And then you remove other expenses such as your cell phone hot bags cell phone holders or any other expenses that are necessary and ordinary for the operation of your business. Moreover this money youre required to remove during retirement is no longer earning returns but as pointed out below this is likely negligible. 0 complaints for Cass County Tax AssessorCass County Tax Assessor is rated with a B rating from Business Consumer Alliance as of 3222022.

If you owed 10000 in federal income tax. Click here for information on LB1107 Nebraska Income Tax Credit for School. Find many great new used options and get the best deals for Seven Mile Bridge Overseas Hwy Pidgeon Key Florida Keys Aerial Chrome Postcard at the best online prices at eBay.

For questions on displayed information contact Cass County Treasurer 402 296-9320. For example if you purchased a Ford F-150 Lightning and owed say 3500 in income tax this year then that is the federal tax credit you would receive. The record for a single lap.

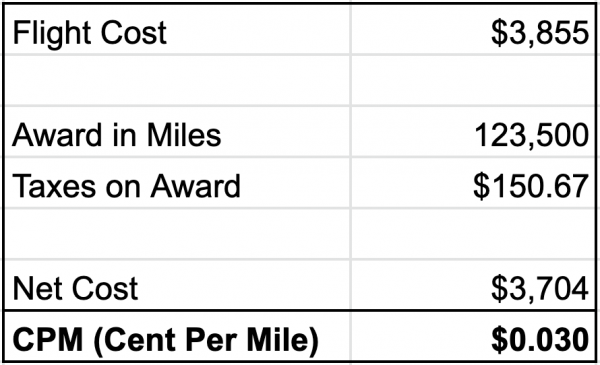

In 2017 this rate fell to 323 and remains there through the 2021 tax year. When I worked in a slightly smaller club I could usually depend on about 200-350 150-260 per night. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022.

However many counties charge an additional income tax. Thank you Reddit for reading and for any perspective. He has told her since he bought the house that her mortgage payments are going towards her owning the househer equity in the house.

In 2022 the mileage allowance jumps to 585 cents per mile. For the 2021 tax year that means 56 cents per mile gets taken off our earnings. Check the complaint history rating and reviews on this company.

Course my tax statement said otherwise. If you travel more than 10000 business miles a year in your private car then the rate drops to 25p per mile in which case you will be taxed on the additional 25p for every mile travelled above 10000 miles. The 2021 standard mileage rate is 56 cents per mile and the 2022 rate is 585 cents per mile.

A tax consultants business could benefit from the expected and considerable upturn in tax-related searches at certain times during the year and provide keyword-optimized tax advice see the Google Trends screenshot below for the phrase tax help. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel.

The True Cost Of Car Ownership The Best Interest

How To Calculate Cost Per Mile Optimoroute

The Cost Of Driving Is Way Higher Than You Think Millennial Cities

How To Calculate Cost Per Mile Optimoroute

Evs Of 2022 Msrp Per Mile Of Range After The 7 500 Tax Credit If Applicable Us Only R Teslalounge

Government Looking To Tax Vehicles Per Mile In Future R Cartalkuk

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

The True Cost Of Car Ownership The Best Interest

The True Cost Of Car Ownership The Best Interest

American Airlines Aadvantage Program A Guide Nerdwallet

The True Cost Of Car Ownership The Best Interest

Infographic Water Use Per Mile Driven Biofuels Vs Fossil Fuels Circle Of Blue

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

How To Earn American Airlines Miles From Your Savings Forbes Advisor

Gas Mileage Log And Mileage Calculator For Excel

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

The New Break Even Cost Per Mile For Truck Owners R Freightbrokers

Best Warehousing Logistics Solutions India Infographics Infographic Information Graphics Logistics

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc